You Make Better Decisions If You “See” Your Senior Self

Submitted by Moneywatch Advisors on September 12th, 2019Ever use one of those aging apps where you take a photo and the app ages you 20 or 30 years into the future? I won’t look like that! That’s crazy! Delete! Well, not so fast my future wrinkled friend. Maybe an app like that can inspire us to invest more for our retirement or exercise more or cut out sweets…well, let’s not get carried away.

In a study by Hal Hershfield, an economist from UCLA, people who viewed aged images of themselves were more inclined to increase their savings for retirement. Hershfield used software to age half of the subjects in his study with jowls and wrinkly skin – all those things that won’t actually happen to me or you, thank goodness. They then gave all the study subjects a fictional $1,000 and gave them four choices for how to use that money: investing in a retirement fund, give a gift to a friend now, planning a fun event or putting money into a checking account. People shown their aged images put twice as much money into their retirement fund as those who weren’t. If shown aged images of someone else, though, their choices weren’t affected.

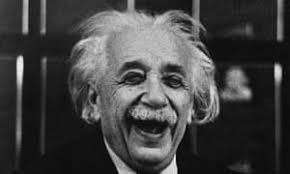

Should I invest in that man below?